How to Process Tax Refund in Nigeria

How to Process Tax Refund in Nigeria

A tax refund or tax rebate is a refund on taxes when the tax liability is less than the taxes paid. Taxpayers can often get a tax refund on their income tax, if the tax they owe is less than the sum of the total amount of the withholding taxes and estimated taxes that was paid, plus the refundable tax credits that they claim. Tax refunds are often paid after the end of the tax year.

In Nigeria, despite the guarantee of a tax refund by Section 23 of the Federal Inland Revenue Services

Act and Section 16(1) (b) of the VAT Act, from available evidences, the Federal Inland Revenue

Services do not always comply with these provisions as it always fails to refund excess tax whether in

the form of VAT or arising from the withholding tax system.

One devastating impact of non remittance of excess tax is the constant reduction in the cash flow of the company or individual businesses. This attitude is a flagrant breach of taxpayers’ right and a huge infraction on the legal and constitutional rights of taxpayers in Nigeria.

As mentioned earlier, Nigeria operates a Withholding Tax System (WHT), which means that, in qualifying transactions, the paying party is required to deduct at source, any payment due to a taxable persons or companies. Where a taxpayer has overpaid tax (which usually due to the WHT regime), he is by right entitled to either a refund of the excess tax or set off against a future tax.

In getting a tax refun in Nigeria, the underlisted items must be presented by the Taxpayer before a Tax Refund can be processed:

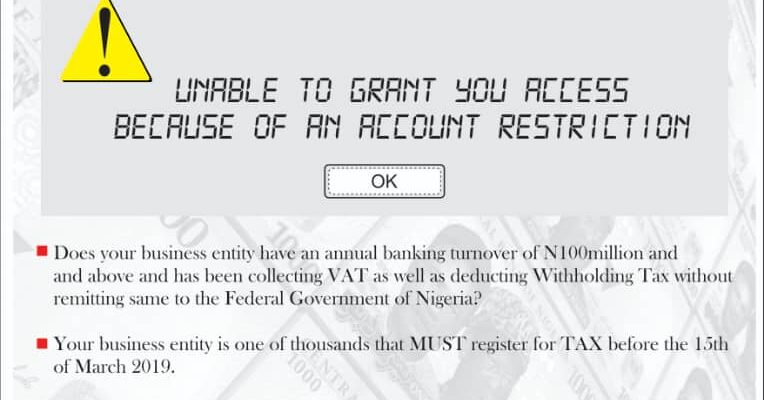

- The taxpayer must be registered for Tax purposes with any of the FIRS Large Tax Offices (LTO), Medium Tax Office (MTO), or Micro and Small Tax Office (MSTO).

- Original copy of Tax Refund Request application from Taxpayer or Collecting Bank stating clearly the following: The precise ground giving rise to the refund e.g WHT, VAT, PAYE.

- The tax type for which refund application is being made.

- The period in which transactions giving rise to request arose.

- The Refund request application from the Taxpayer or Bank should contain the following depending on reason for refund request: Original documents completed by the taxpayer for the transaction; should include: Original FIRS pay-in-slip (Bank Teller) WHT Schedule (when applicable) PAYE deduction Schedule (when applicable) Original copy of stamp duty document (un-utilized stamp duty only). Photocopy of the stamp duty document for utilized stamp duty. Certificate of stamp duty (un-utilized stamp duty only). Letter of authority from the promoters of the company (un-utilized stamp duty only) E-ticket (Electronic payment acknowledgement receipt) Copy of cheque / draft /payment instruction used for the payment Original FIRS receipt issued for the payment Where the correct payment was affected, the photocopy of FIRS receipt issued for the correct payment and original copy of FIRS receipt of the Overpaid amount.

- Tax Refund Application will be processed in the name that appears on the Pay- Direct platform in case of existing Taxpayers.

- Banks are required to provide an indemnity letter for all refund being sought. This indemnity letter must be duly stamped at our appropriate stamp duties office.

After the above documents have been submitted,they will be carefully verified and audited where applicable by FIRS and only successful applications will be passed on to the approving authority for Tax Refund, which must be made within ninety (90) days of the decision of the Service that you qualify for a refund.

For more information:

At SOW Professional Services, as a professional tax consultant in Nigeria, we understand how tax refund can be done and can assist you with the process. Please call: Call us on: 07038254989 or send a mail to: care@sowprofessional.com, WhatsApp:07038254989, www.sowprofessional.com

Leave a Reply

You must be logged in to post a comment.

What a post! That is so chock full of useful information I

can’t wait to dig deep and get started using the resources you’ve given me.

Your exuberance is refreshing.

Best regards,

Balle Valenzuela

Dear Sir,

We are glad that our information is of great use to you, we thank you for your feedback and also wish you can get across for further supports.