What You Need to Know about Tax in Nigeria

Taxes/Taxation in Lagos Nigeria is a means by which governments finance their expenditure, by imposing charges on citizens and corporate entities. It is as a way of making individuals, persons and companies contribute to growth and development of a country, through payment of money, via legalized levies according to their level of income or any other criteria set by the government. Money generated from Taxes in Lagos Nigeria is used to encourage or discourage certain economic decisions.

According to the Federal Inland Revenue Service (FIRS), the authority charged with tax adminis tration in Nigeria, defines tax compliance as obeying provisions of tax laws willingly, without being compelled. This means registering yourself, enterprise, non-governmental organization or a government agency with tax authority and equally, keeping proper records, preparing tax returns, filing and payment of taxes.

tration in Nigeria, defines tax compliance as obeying provisions of tax laws willingly, without being compelled. This means registering yourself, enterprise, non-governmental organization or a government agency with tax authority and equally, keeping proper records, preparing tax returns, filing and payment of taxes.

Regular payment of tax by parties involved, help to maintain steady and sustainable national development by a responsive government.

Below are the various taxes in Nigeria collected by the FIRS;

- Value Added Tax (VAT):VAT is a tax placed on a product, whenever value is added at a stage of production and at the final sale. VAT is a way of charging tax on the increase in value of goods and services at each stage of production. This is the commonest that every one who buy or enjoy services, pays.

- Personal Income Tax (PIT):This is the type of tax that government imposes on financial income generated by every entity within its jurisdiction. Thus, by law, every individuals must file an income tax return every year to ascertain if they owe any taxes or are qualified for a tax refund.

Personal Income Tax rate payable is not a fixed sum, depending on the gross income of the taxable employee, and the tax relief granted to him under Personal Income Tax Act (PITA).

Each state has its State Internal Revenue Service that handles tax administration, while Federal Inland Revenue Service administers PITA in the Federal Capital Territory. A person liable to PIT is expected to compute his tax liability, file tax return and pay tax, if any, accordingly on a calendar year basis. Tax paid on one’s personal income as distinct from the tax paid on the firm’s earnings. In an incorporated firm, the owners (shareholders) pay taxes on both their income (salary or dividend from the firm) firm’s income (profits). In partnerships and sole-ownerships, the tax is paid only once on the firm’s profits.

- Withholding Tax (WHT):Withholding tax is payment of income tax in advance. Because it is not a distinct tax type and has no legislation of its own, WHT is only a mechanism for collection of other taxes that may have been lost through evasion and/or avoidance.

- Education Tax (EDT):A tax of 2% of assessable profits is imposed on all companies incorporated in Nigeria. This is done to ensure that all companies contribute to the development of the education sector

- Petroleum Profits Tax (PPT):This act imposes tax on profits of upstream petroleum operations. Upstream petroleum operations refer to exploration of petroleum products, mining and drilling. Downstream petroleum operations on the other hand refer to simple sale and distribution of processed oil products by local corporations. Therefore, corp

orations engaged in upstream exploration are subject to Petroleum Profits Tax (PPT), while downstream corporations are subject to Companies Income Tax (CIT). The current rate of petroleum profits tax is 50% for operations in the deep offshore and inland basin and 85% for operations in the onshore and shallow waters. - Companies Income Tax (CIT): Though the rate of Corporate Income Tax (CIT) paid by a business varies from one country to another, yet it is important for the owner of a company to know what obtainable in his/her own country. Under the Companies Income Tax Act of Nigeria, a resident or non-resident company incorporated in Nigeria must pay Companies Income tax. This is done by an annual self-assessment and submission of tax returns according to specifications of the Federal Inland Revenue Service (FIRS). For non-resident companies however, tax payment is done through remittance. For CIT, tax payable for each year of assessment on profits of a company accruing in, derived from or brought into Nigeria stands at 30%. Companies paying dividends to shareholders are required to first pay tax on profits at the companies’ tax rate. Below are companies subject to the Companies Income Tax:

- Companies resident in Nigeria, with the exception of companies involved in petroleum operations.

- Foreign companies whose income is earned from Nigeria.

- Organizations concerned with profit making activities other than promotion of their primary objects

- Liquidator, receiver or agent of liquidator or receiver of any taxable compan

y or organization.

y or organization.

- Capital Gains Tax (CGT):This refers to all gains accruing to a taxpayer from the sale or lease or other transfer of proprietary rights in a chargeable interest which are subject to a CGT of 10%. In simple terms, CGT is a tax on profits obtained from a disposal or exchange of some kinds of assets.

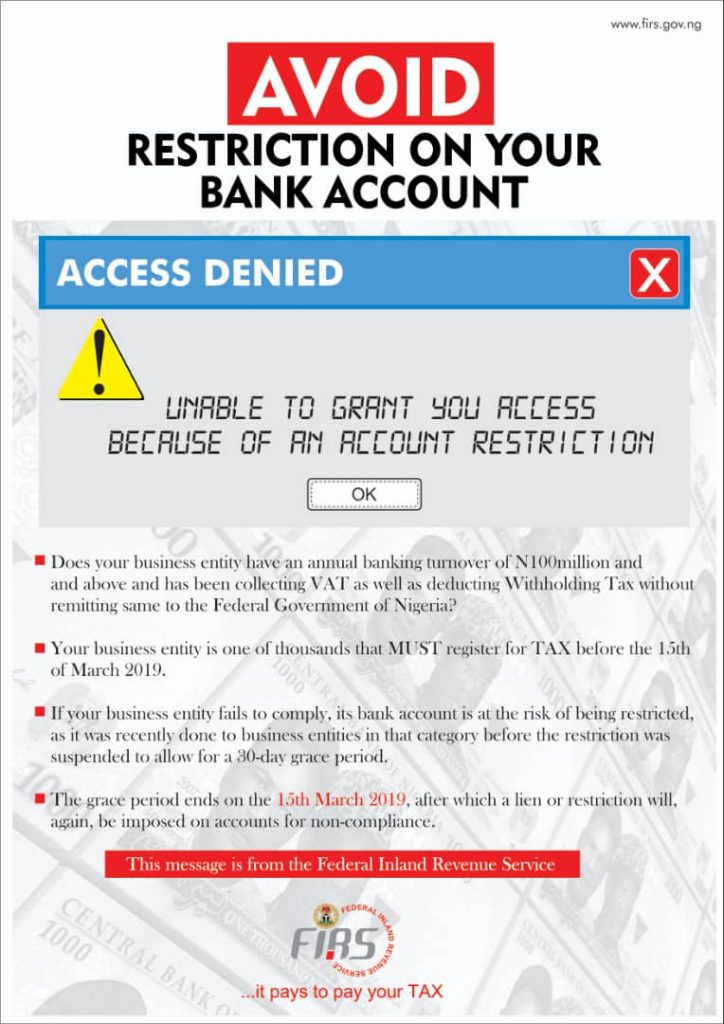

With the ongoing drastic drive by the tax authority(s) in Nigeria, on fund generation, vis-a-vis, the threats to shut down the bank accounts of defaulting organisation or individuals, it has become imperative for us, especially SMEs to ensure, that our tax are properly managed.

For more information:

At SOW Professional Services, we understand the benefits of tax administration to organisations and we can assist you with the process. Call us on 07038254989 or send a mail to care@sowprofessional.com, we can help you determine the right product for your business.