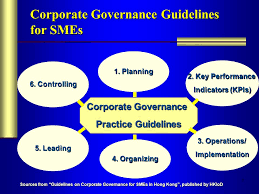

Corporate Governance Key to SMEs Growth

Definition:

Corporate governance is the system of rules, practices and processes by which a firm is directed and controlled. Corporate governance essentially involves balancing the interests of a company’s many stakeholders, such as shareholders, management, customers, government and the community.

Apart from the formal stakeholders, families and other dependents of organizations are other groups that corporate governance protects

Since corporate governance also provides the framework for attaining a company’s objectives, it also incorporates practically, every sphere of management, from action plans and internal controls, to performance measurement and corporate disclosure

Corporate Governance in Nigeria

It also refers to internal disciplines or systems, which govern the relationships among ‘key players’ or entities. Moreover, it supports the organization’s sustainability on the long term and establishes responsibility and accountability.

The guidelines of corporate governance aim to achieve greater transparency, fairness and hold executive management of the organization accountable to stakeholders. In doing so, corporate governance plays a pivotal role in protecting shareholders. In the meantime, duly considers the interest of the organization at large without bias to employees’ rights. Though, executive management should have reasonable level of power to run the business. Corporate governance ensures that, such powers are set to practical dimensions in order to minimize misuse of authority to serve objectives, not necessarily in the best interest of the shareholders. Therefore, it provides a framework for maximizing profits, promoting investment opportunities and eventually creating more jobs.

In general, corporate governance highlights two major principles:

- Oversight and control over the executive management’s performance and strategic directions.

- Accountability of the executive management to the shareholders.

For these reasons, the principles of corporate governance apply on those who assume the ultimate responsibility for success or failure of the organization. On the other hand, it is imperative to understand that the proper implementation of good corporate governance does not necessarily guarantee success of the organization. However, contemporary realities have shown that, a bad corporate governance practice is certainly a common syndrome causing failure in many organizations. One of such, is the recent collapse of Skye bank and many other organizations in Nigeria.

It is interesting to know, that a recent survey revealed, that more than 70% of investors are willing to pay additional premium over stock prices for companies known to implement sound corporate governance practices as opposed to other companies which may have same level of profitability but characterized with inefficient management or a record of poor governance practices.

The delusion about SME’s upholding and complying with the dispositions and principle of corporate governance stems its roots from the composition, size and contribution of this segment to the economy. The reality today is that SMEs may appear small in size but likely many of them have potentials to grow and become big entities in future, if only corporate governance can be employed. Unfortunately, this foresight still not well realized and as a result, implementation of good corporate governance practices continues to be ignored by SMEs.

In Nigeria, SMEs form large segment of business activities, largely, they take the form of private companies owned by small number of shareholders. Often have between 3 – 50 employees. The SMEs also involve the informal sectors, which have more than average of participants in the entire economy. Such companies are usually family-owned run by family members where the authorities and powers are generally held by an individuals. For that reason the owners commonly consider them as running their personal properties.

Perhaps the question that strikes the mind of business owners and directors of SMEs as well as the executive management team is “why should we opt to choose to introduce new systems and internal rules, which impose limits on the way we do business and our business conduct?“. The answer is simply corporate governance plays a significant role for SMEs growth and development. It defines the role of shareholders as owners on one hand and as business managers on the other hand. This is best done through a process that spells out governance rules and guidelines.

Objectives:

These principles and code, aim to assist all parties to understand how to manage the organization. As a result, internal conflicts would be better managed and more attention given to achieve growth objectives and support profitability. There are at least four reasons for small and medium size companies to show greater interest to implement corporate governance principles:

- The good governance practices pave the way to companies to grow or attract additional investors as alternative to raising capital through borrowing from banks at high cost. Additionally, companies may consider going public through IPO.

- Sound governance practices lead to improved internal control systems, which results in more accountability and higher profitability. The latter is attributed to enhanced controls, which minimize the likelihood for fraud or losses.

- Corporate governance framework ensures that shareholders are freed from executive and administrative duties. As a result, conflicts among business owners who assume management roles in the organization would be reduced to a greater extent particularly in organizations owned by few numbers of shareholders where the distinction between ownership and management capacity is unclear.

- Corporate governance help to secure the going concern of an organization, as adequate provisions are enhanced for succession and continuity, thereby; owners and other stakeholders can transfer their interest to their beneficiaries.

Resistance to corporate governance framework is not peculiar to Nigeria, but also in most developing countries and some greedy executives in advanced society. This is mainly due to lack of awareness about what corporate governance is about and its relationship with corporate performance and objectives. Executive arrogance and eroded values in Nigeria and West Africa region also contributes to this evasion. Moreover, the widespread myth that implementing corporate governance entails high costs, coupled with doubts, that such cost would not commiserate the envisaged benefits to the organization.

The biggest challenge for small and medium size companies in Nigeria is about how far they can cope with the external business conditions and internal problems, which threaten their ability to survive. Surveys indicate that one-third of this category of companies collapse after three years and 70% collapsed on or before 5 years of commencement for the following reasons:

- Absence of planning and forward thinking

- Inadequate leadership and management skills at senior management level

- Lack of future business plans for growth and new investment plans

- Problems with cash flows Inability to innovate, present ideas for business development and cope with ever changing business environment and economic conditions

- Inadequate access to technical assistance

If we consider these reasons, we may conclude that implementing corporate governance will contributes to a reasonably to support chances for these companies to perform well, grow and adopt better process for decision making. For family owned businesses, corporate governance improves management efficiency, limits internal conflicts and helps in making transition of ownership to heirs a smooth process.

Practically speaking, we need to realize that SMEs may face several problems in implementing corporate governance framework, which seems expensive. Consequently, it is essential that consideration should be given, by responsible authority to reduce the relevant requirements for compliance and disclosure and introduce less expensive financial and administrative alternatives, which such companies can afford.

Owners and stakeholders of business should equally have a sense of responsibility to engage Business or Management Consultants, who can assist in business advisory and processes.

In order to help small and medium size organizations to implement corporate governance, we recommend that the government issue a code for SME’s corporate governance similar to that issued by General Authority for Investment.

Particular attention should be given to the following: Transparency, Processes and Compliance.

About Us:

-

For more information:

SOW Professional Services, is a reputable Management Consultants in Nigeria, as a professional Management Consultant in Nigeria, we understand how organisation’s problems can be resolved, hence, we look forward to assist you with this process. Please call: Call us on 07038254989 or send a mail to: care@sowprofessional.com,